FINANCIAL SECURITY & INVESTMENT INC.

Invest your time and efforts on running your business. Leave the accounting to us

- Banking

- Commercial & Personal Loans

- Mortgages

Services

We strive to exceed our clients’ expectations

For yourself, your family, and your business, we have the expertise, experience and resources to help you achieve your financial goals. Count on us for retirement and investments planning, mortgage solutions, and smart cash management strategies

01.

Fund & Treasury accounting services

We adhere to high moral principles and professional standards by a commitment to honesty, confidentiality, trust, respect and transparency. We collaborate and share knowledge to benefit clients and fellow advisors for the advancement of our mission.

Our vast network of services leverages the benefits of shared knowledge across our entire offering to better deliver timely and accurate portfolio accounting and reporting.

02.

Tax Planning

There are typically no federal income taxes on insurance policy proceeds. You might also bypass probate. When you structure your insurance plan properly, you may receive proceeds free from estate taxes. Another potential benefit of an insurance policy is that the cash value builds on a tax-deferred basis. No taxes are due as long as the insurance policy remains in force.

03.

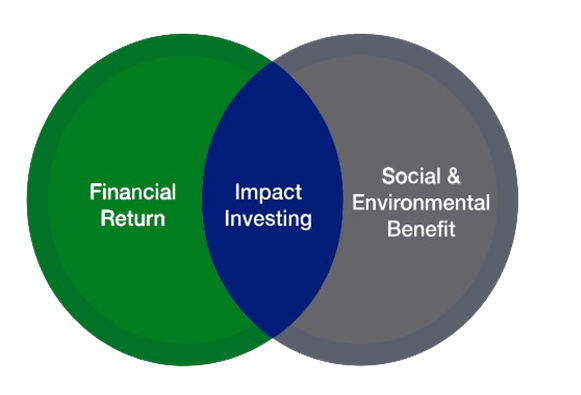

Comprehensive Finance Investment Advisory

Some custodians limit what you can hold. We support all depository-eligible securities, as well as most mutual fund and alternative investment holdings. Additionally, we support global trading in more than 20 countries.

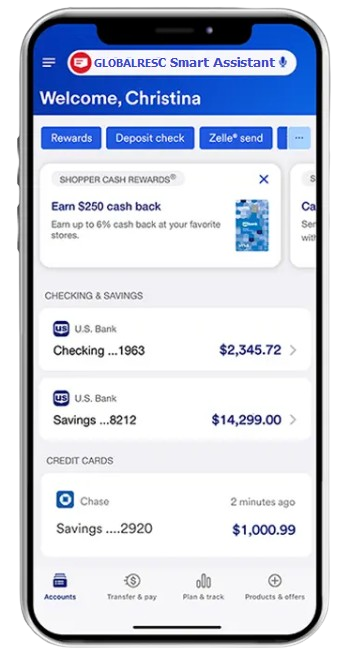

As a financial institution, you need solutions that meet internal expectations and expand your clients’ capabilities. Trust your dedicated U.S. Bank relationship manager to help open new opportunities for you and your clients.

Fund administration services

Business banking strategies

As you look toward your business goals, your banker can help you find innovative ways to manage your assets and liabilities with professional service firms have unique and complex banking needs. We can help you find the right combination of personal and business banking options that complement your overall wealth plan. Our bankers will consult and support your firm by providing credit commitments

Always On Time

Take control of your wealth with personalized guidance

Hard Working

Delivering the exceptional banking services and navigate the greatest opportunities for your organization

24/7 Availability

delivering flexible, comprehensive services to help you stay focused on growth

MUTUAL FUND & TREASURY SOLUTIONS

Fund & Treasury Accounting Services

Get In Touch With Us

Comprehensive services for mutual funds

- Treasury management services

- Foreign exchange

- Deposit services

- Merchant services

- Operating lines of credit term loans

- Loans for capital improvement

- Commercial real estate loans

- Equipment lease and purchase financing

- Partner capital loan programs

- Partner buy-in or buy-out loans

- Business credit cards and process

- Electronic payment and payroll services

- Commercial real estate loans

- Funding for stock option exercises

- Succession planning

- Partner buy-in or buy-out loans

- Equipment lease and purchase services

- Customer financing options